If you are on a Medicare Prescription Drug Plan (Part D), you might have questions about the pricing and coverage of your plan. If you are on an employer plan but will be retiring or aging into Medicare, you are likely to find some key differences between an employer plan and a Medicare Part D plan.

If you are on a Medicare Prescription Drug Plan (Part D), you might have questions about the pricing and coverage of your plan. If you are on an employer plan but will be retiring or aging into Medicare, you are likely to find some key differences between an employer plan and a Medicare Part D plan.

Deductibles

Many prescription drug plans have an annual deductible. This is a dollar amount (as much as $500) that you will have to pay before the prescription drug plan will cover even $1 of your drug costs. This deductible renews every year, so many seniors find that their prescription drug costs are quite high in January and February. Until you pay the deductible, you are paying the full retail price of your drugs. Just to make things confusing, some insurance plans won’t charge you the full retail cost of drugs that are generic. Sometimes, you only have to pay the full retail price of brand-name drugs to pay down your deductible. Once you’ve paid out the deductible, the insurance kicks in.

Coverage and Co-Pays

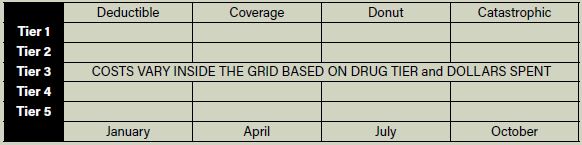

OK, you paid that deductible, so now you won’t have to pay that much. Right? Well… that’s likely. But the drugs will still come at a price. Once you are in your coverage period, you will be paying the co-pay for the drugs. And there are up to six different levels of co-pays – called tiers.

Tiers

Drug companies divide drugs into (five or six) categories, called tiers. The lower the tier, the less expensive the drug. Tier 1 drugs tend to be preferred generic drugs and Tier 5 (or Tier 6) tend to be very expensive, specialty or brandname drugs.

The Formulary

A prescription drug formulary is the list of drugs that are included in your prescription drug plan. Wait… Not all drugs are included? No! But every formulary has to include drugs from specific categories established by Medicare. For example, if you are on insulin, then there is at least one insulin in every drug plan. But your exact brand of insulin might not be included.

Donut Hole

What’s this crazy donut hole people talk about? Think about your prescription drug plan like a gift card. And at the beginning of the year, there’s around $4,000 on the card. As you fill prescriptions, the insurance company is deducting the RETAIL COST of drugs against that $4,000. Once the drug company has paid out the roughly $4,000, you fall into the donut hole. Once in the donut hole, you have to pay a lot more for your drugs. Some people with lots of prescriptions will fall into the donut hole in April or May while others will never even come close. Some people even pass out of the donut hole and land in catastrophic coverage, where drug costs can dramatically decrease. Prescription drug coverage is like a grid. You’ve got the drug tiers along the side; the categories along the top; and the calendar year along the bottom. If you have questions about your prescription drug plan, call your broker to review your likely costs for 2020.